Back to the Shores | Reshoring and Onshoring

What market forces are driving reshoring and onshoring in 2020?

Reshoring of industrial manufacturing and distribution has been underway in the US for nearly a decade. COVID-19 has exposed gaps in supply chains and brought the re-emergence of manufacturing in the US into the limelight.

Several factors have caused companies to reconsider the US for their manufacturing expansion or relocation. A significant one is energy. Low-cost shale gas has transformed energy competition to provide the US an advantage – especially for heavy users of automation. What’s more, the United States government has used tariffs to improve the competitive posture of domestic producers.

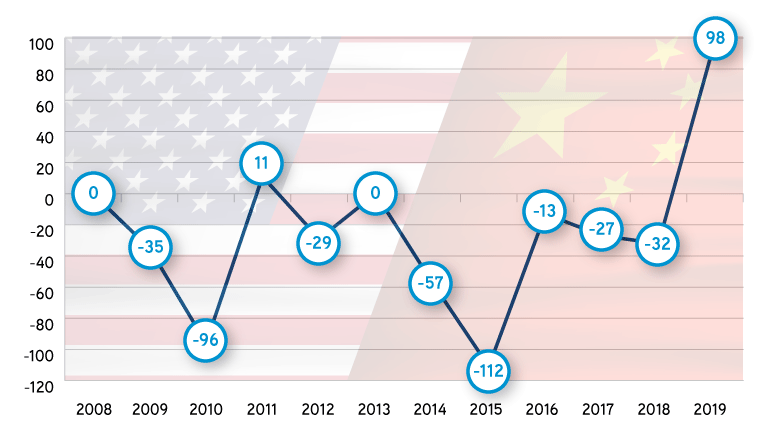

The graph below shows the Manufacturing Import Ratio (MIR), which measures the US import ratio relative to 14 Asian countries. A positive rate is a leading indicator of reshoring initiatives. In 2019, the MIR sky-rocketed to 98 reflecting the US policies of import diversification are indeed working.

The US-China trade war caused reshoring to spike

Supply Chains and Costs

The coronavirus pandemic has escalated the importance of mitigating risks of global supply chains. The worldwide disruptions and delays caused by COVID-19 are challenging legacy operating models that focused on only one aspect of cost when making location decisions.

For decades, lowering unit costs has been driven in large part by less expensive labor. However, the emerging middle class in Asia and around the globe is putting upward pressure on wages.

Historically, high American wages have been the justification for companies’ moving production offshore. Thanks to the global middle class doubling from 1.9 billion in 2009 to 3.2 billion in 2020, the gap is closing. And as manufacturing automation picks up speed, the US is no longer being rejected on wages.

In fact, one of the strongest cases for reshoring operations and/or onshoring new facilities is implementing automation in factories and distribution centers. Boosting productivity per square foot by embracing robotics and artificial intelligence allows even greater throughput and efficiency. According to recent FRED data, US manufacturing output is higher than ever, and much of that is thanks to automation.

Total Costs Paradigm

Going forward, industrial businesses will no longer focus on one aspect of lowering costs. The total cost of goods and similarly important, supply chain risk, will be taken into consideration to determine where the next wave of production and distribution is located. Critical cost elements include:

- Energy – The cost of power in the US has been an essential component in attracting industry for nearly a decade. The US’ ability to extract shale gas as a low-cost fuel source is a key driver for foreign-based investment in new facilities. The US has become energy-independent thanks to the shale oil revolution, leading to a stable, low-cost, fuel source for power generation. There’s a reason power plants are transitioning to natural gas. The reliable power infrastructure in the US only serves to bolster the competitiveness of manufacturers transitioning to more automation.

- Taxes – The US government has made it a priority to level the playing field on taxes, most notably through tariff reform and The Tax Cuts and Jobs Act of 2017. Pro-growth communities in the US are hungry to provide tax incentives to attract business. Post-COVID-19, we expect to see an incentives comeback as witnessed following the Great Recession.

- Transportation – Through the pandemic, limited access to goods produced offshore has put considerable strain on global supply chains. A North American solution for US operations will significantly lower transportation costs to the end consumer as well as improve product availability.

- Wages – The emerging middle class around the world is closing the wage gap with the US. Furthermore, automation is the great equalizer and the US has shown a propensity to implement automation.

The Waves are Getting Bigger

A recent Thomasnet.com survey of nearly 1,000 US-based manufacturers found that 64% are likely to bring production back to North America. In other words, 600-plus decisions could be made for new production, reshoring production, or some combination of both. This aligns with the data pointing to the benefits of reshoring: fewer imports from Asia, lower risks to supply chains, and reduced total costs.

Colliers Site Selection Services teammate and SVP of Supply Chain, Gregg Healy, sees the ongoing reality turning into a China Plus One model. The economies of the United States and China are too great to abandon either and as Gregg puts it, “no one wants to get caught in this situation again.”

Companies in the US such as GE Aviation, Walmart, Zentech and Hubbardton Forge are ahead of the next wave and have been actively reshoring and onshoring with great success. However, there is no one-size-fits-all model.

Our team has partnered with many foreign producers to locate new production and distribution in the US. In each scenario, Wages, Taxes, Utilities and Transportation were vital components. But, even these four buckets of cost are only part of the story.

What Can You Do?

Reshoring or onshoring new facilities is a complex, multifaceted problem and it requires a solution equal to the task. Focusing on the correct datasets that will optimize supply chain and lower costs is crucial. The location decisions made today can impact the company’s bottom line for the next 10, 20, or 30 years.

Colliers offers industrial corporations Indsite®, a unique tool to minimize risk and costs attendant to major capital projects. Indsite scans critical business environment characteristics – nationwide – to identify the locations that meet all user-defined location criteria. It is driven by big data with over 200 datasets that enable granular analyses and comparisons of labor availability and quality, operating costs, labor union risk, access to critical infrastructure, operational risk, and more – for an unlimited number of locations anywhere in the United States.

For companies looking to make decisions to reshore or onshore new operations, synthesizing critical information will eliminate locations that won’t work and elevate locations that will.