Summary

As the global economy hits reset, unemployment claims explode, and businesses across the globe fold, incentives may become front and center once again. Economic inducements will be crucial in aiding companies to hit internal rate of return metrics.

Can incentives take a location from Good to Great post COVID-19?

Are Incentives Poised for a Comeback?

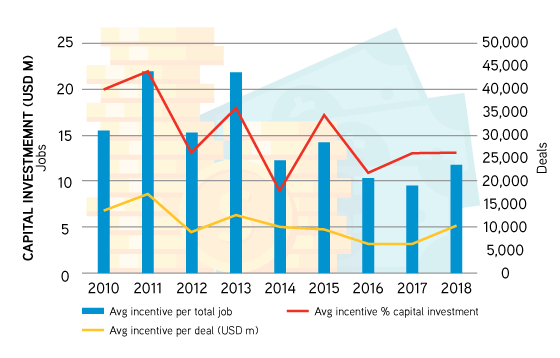

Issued at the beginning of 2020, Wavteq’s Global Incentives Report illustrated a downward trend in incentive dollars between 2011 and 2018. Although 2018 showed a slight upward tick (see graph below), the overall trend continued to show a decline in the average incentive per total job, average incentive as a percent of capital investment, and average incentive per deal.

After years of expansion and strong growth, economic inducements provided by communities, states/ provinces, and countries have been brought to the forefront. Incentives are sometimes deemed “corporate welfare” by the Left and “government picking winners and losers” by the Right. It’s easy to see incentives have had a rough go as of late, and who is there to blame with a robust economic outlook and record-low unemployment. But things have changed rather quickly these past two months as a result of the COVID-19 global pandemic.

Has COVID-19 changed the Game?

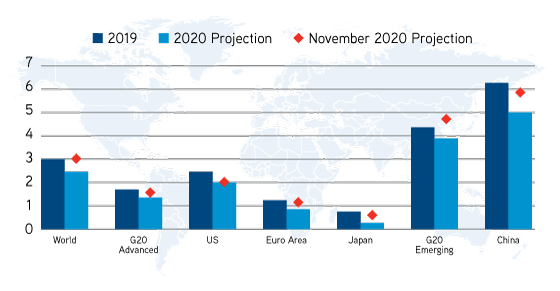

The Organization for Economic Co-Operation and Development (OECD) issued a special interim report on March 2nd, 2020 regarding the impact COVID-19 will have on the global economic stage. As of March 2nd, OECD was forecasting real GDP growth worldwide to decrease from 2.9% in 2019 to 2.4% for 2020, representing a 0.5% drop from their 2020 projection cast in November.

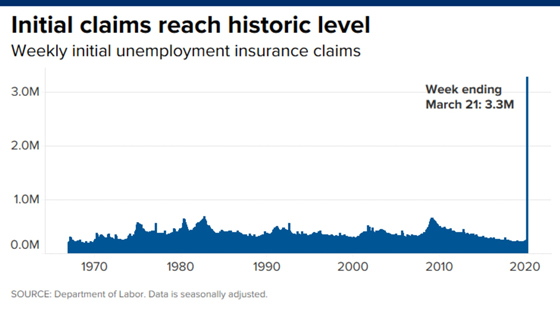

In the United States unemployment claims climbed to over 3 million on March 26 according to the Department of Labor, the highest ever recorded. A CNBC article noted, “the number shatters the Great Recession peak of 665,000 in March 2009 and the all-time mark of 695,000 in October 1982.” Who knew this was only the beginning as claims rocketed to over 30 million by the beginning of May.

Is the stage set for a comeback?

So, the question is, are incentives poised to make a comeback? Will we see incentive metrics hit the highs witnessed in 2011 as the global economy was looking to recover from the Great Recession?

As the global economy hits reset, unemployment claims explode, and businesses across the globe fold, incentives will likely become front and center once again. Economic inducements will be crucial in aiding companies to hit internal rate of return metrics.

Slowed growth should yield fewer capital investment projects leading to fierce competition between jurisdictions. All of this points to financial incentives playing a decisive role in whether projects move forward and where those projects invest in the months and years to come. Keep in mind, incentives are only part of the decision matrix and ultimately help good locations become great locations. Supply chain, operating costs, infrastructure, talent availability and pipeline, are just a sample of the driving forces to consider when contemplating expansion.

From Good to Great

Historically, Colliers Site Selection Services has been able to capture 15% or more of capital investment in incentive offsets and subsidies. Take for example our site selection of a 600,000 SF distribution center for AutoZone in Texas. Our team was able to negotiate expense offsets and incentives worth 23% of the project’s total capital expense. (And that is just one example- click here for more examples.)

If your company is looking to expand at an existing operation – including regular capital maintenance with the potential of additional jobs – or a new greenfield investment, let’s have a quick discussion to see how Colliers Site Selection Services can be of service.