Pursuing economic incentives maximizes a company’s return on investment for their real estate portfolio. Whether clients are considering new or existing facility expansion opportunities, new job creation, or new capital investment deployment, incentive negotiations are a difference-maker. Neglecting incentives risks leaving significant aid on the table that could provide an operation a hand up during important milestones such as initial ramp up of production or expanding capacity.

The Colliers Economic Incentives team is comprised of experts who navigate the entire incentive process from strategy development through implementation with solutions targeting all facets of a project from facility development, utilities, taxes, real estate transaction, and recruiting and training.

Here are the trends our experts have observed during 2022, how this year’s performance compares to the previous five, and forecasting what 2023 could bring.

A Look at the Last Five Years

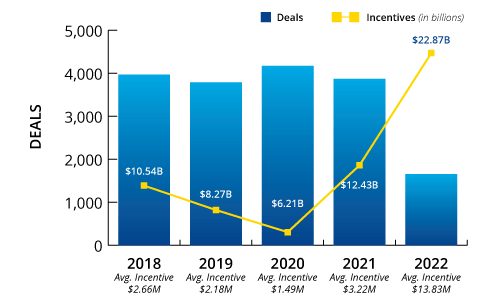

To better understand 2022’s performance, it’s important to look at the bigger picture, going back to 2018. Including two years of pre-pandemic data helps provide more context with comparison to a more normalized market.

Before 2020 the average number of deals annually was nearly 3,900, according to the most complete datasets tracking incentives. In fact, this number jumped after the onset of the pandemic, 2020 brought a 5 year high just under 4,200 before 2021 saw a return to the norm at around 3,900.

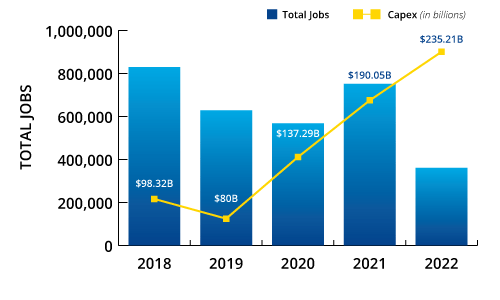

The two years prior to COVID-19 the average project capital expenditure was $32.7 million, but that average shot up the following two years. This can be explained by the rise in the number of mega projects locating in the United States driven primarily by the electric vehicle industry. Numerous high-profile mega projects have been announced in the last two years and there has been an observable increase in similar projects with total capital expenditures at mega project scale in the data.

This Year’s Performance

Due to the ongoing pandemic, and now economic instability, incentives have been crucial to the sector’s recovery. While there were consistent trends in the previous four years, 2022 numbers through Q3 have deviated.

Unlike the pre-pandemic and pandemic years, 2022 has seen a sharp increase in overall incentive dollars, while the volume of overall deals has halved from 2021. This drop is largely driven by the continued surge in megadeals taking place, which is indicated by the continued rise in capital expenditure.

2022 is also reporting the highest capital expenditure overall over the last five years, averaging $179.8 million, up from the 2018-2021’s average of $54.1 million.

Outlook for 2023

It’s likely the volume of megaprojects will continue for 2023, keeping that overall deal volume lower than previous years. According to research from the Site Selectors Guild, these mega projects which exceed $1 billion will increase over the next five years, especially for the automotive and electric vehicle battery industries. However, if economic volatility heightens, and depending on the geopolitical climate, this “mega” level activity could be hampered.

Although we have yet to see the final Q4 data from this year, the curveball numbers from 2022 demonstrate how hard it can be to accurately pinpoint what’s to come, especially given the unique market conditions of today. Rising interest rates, inflation and ongoing supply challenges will continue to create a difficult environment for transacting and increase the criticality of identifying all available incentives to offset upfront costs and reduce ongoing operating expenses.

Click here to contact Monty Turner and the Colliers Economic Incentives platform.

Leave a Reply